Who’s Behind the Flurry of Influencer-Backed Beauty Brands?

A handful of private label companies — with a focus on speed, agility and new marketing models — are making a lucrative business of birthing influencer-backed beauty brands.

NEW YORK, United States — Last week in SoHo, the streets were unusually chaotic and crowded as hundreds of people — many of them teenagers — lined up outside of 27 Mercer Street. Some had been waiting in line — in the frigid February temperatures — for nearly 48 hours; the crowd was so diffuse and excitable that police had set up barricades. The reason for the pilgrimage? Kylie Jenner’s Pop-Up Shop, which promised, among other things like graphic hoodies, the chance to buy items from her frequently sold-out Kylie Cosmetics line. Two years after launching the brand, demand for the products — which include Kyshadow and Lip Kits — is as high as ever.

The rise of social media has provided new opportunity for niche beauty brands. Digital influencers, like Jenner, have been quick to capitalise. Indeed, it seems every other month a beauty concept is announced with a famous (or at least Instagram-famous) name attached. But who is making all this stuff? More often than not it’s the same few private label companies, including Seed Beauty, Hatch Beauty, Maesa Group and Kendo Brands, who — with a focus on speed, agility and new marketing models — are making a lucrative business out of building influencer-backed brands from the ground up.

“You’re going to see more and more of these companies come up as these large conglomerates that don’t really stand for anything start to get dismantled, and we’ll see a big increase in niche brands that don’t really need a lot to survive,” says Connor Begley, co-founder of Tribe Dynamics, a marketing technology firm. Tribe tracks and measures content creation and engagement across 50,000 beauty, fashion and lifestyle influencers using a metric called Earned Media Value (EMV). EMV quantifies the value of social word-of-mouth among digital content creators who influence purchasing decisions — and according to Tribe it can predict future revenue growth and market share. It should come as no surprise that topping Tribe’s list of high-growth celebrity or influencer created brands, with a year over year EMV growth of 620.87 percent, is Kylie Cosmetics, the breakaway success founded by Kylie Jenner.

Kylie Cosmetics is the gold standard in celebrity or influencer-backed beauty brands; if there was ever any doubt about the selling power of such brands, Kylie Cosmetics quickly put that to bed. The brand launched in November 2015 with a series of Lip Kits, priced at $26 each, which sold out in seconds, some winding up on eBay for close to $300. In the midst of its stratospheric success, beauty fanatics and industry insiders almost immediately began speculating about who was manufacturing the offering. But it wasn’t until May 2016 that the company behind the venture was revealed: Seed Beauty, an Oxnard, California-based company founded in 2014 by brother and sister team John and Laura Nelson. In addition to Kylie Cosmetics, Seed also manufacturers Colourpop, a beauty brand that frequently collaborates with influencers.

We’ll see a big increase in niche brands that don’t really need a lot to survive.

“People would be shocked at how hands on Kylie is,” says Laura Nelson. “We are here strictly to actualise and support her vision, and obviously to do the insane business operations side of things, the fulfilment. Which is no small task with a brand like that.”

The partnership with Jenner has been a boon to say the least, but Seed’s unique business model also gives them an edge on competitors. “Traditionally the product development process is filled with starts and stops and delays while you wait for feedback,” says Nelson, who has over 15 years of experience in the business, many of which was spent running Spatz Labs, a global supplier to the makeup industry owned by her family. “At Seed, we believe in a really fluid development process where that feedback is happening in real time.”

The company pays close attention to its e-commerce and social media platforms to glean near-immediate consumer insight. “We do everything under one roof, from concept, packaging, development; from making the product all the way through launch to shipping and fulfilment, and that allows us to understand what the consumer is looking for and asking,” she says. That kind of vertical integration allows Seed to align resources and development at the pace set by a consumer who is demanding newer and better products at ever-increasing speed.

According to Nelson, Seed can take a product from concept to consumer in just five days. Last year, for example, Seed was able to action on an idea with one of its collaborators, beauty YouTuber KathleenLights, in a matter of days. “Kathleen had a successful Lippie Stix with [Colourpop] called Lumière and people were asking for the colour to come in an ultra-matte,” says Nelson. “Five days before her birthday last year, she was coming out to LA and we say, ‘Hey what we should do for your birthday is we should launch Lumière in ultra-matte.’ So we made it in the lab, gave her a couple of options, revised it and updated it and within five days we went from idea to actually launching on her birthday and being able to ship to consumers.”

Like Seed, Hatch Beauty is also in the business of building and launching new beauty concepts, often in partnership with influencers or celebrities. Hatch’s portfolio includes haircare by celebrity hairstylist Orlando Pita, makeup by celebrity makeup artist Kristofer Buckle and a line of nail products from Jenna Hipp, the “green celebrity manicurist.”

“Hatch can take an idea for a completely new brand and get it on shelves in less than a year, from soup to nuts,” says Hatch president Michael Sampson. “You have to have a model where you can parallel path, so retail strategy, product development, innovation are all happening at the same time. It’s all hands on deck, all pedal to the metal, all at once, to get to the end goal of this consumer, who loves discovery.”

If Hatch and Seed handle the nuts and bolts, it’s influencers that bring the secret sauce: authenticity. “Brand authenticity is the buzzword,” says Sampson. “Every brand has its own DNA and every consumer has its own DNA. To tap into that, you really have to have somebody behind the product that lives and breathes it every day.”

This isn’t just clever marketing (though it is certainly that, too). “The reason why so many of these product lines are successful is that a lot of these influencers or celebrities genuinely know a lot about beauty products,” says Tribe’s Begley. “They’re obsessed with them and they usually have a pretty good idea about what what kind of product they want to make.”

Begley points to Estée Lauder’s partnership with Kendall Jenner as an example of how, without this genuine interest in the product, collaborations can fall flat. “It didn’t work that well because Kendall openly tells her fans she doesn’t like cosmetics,” he says. Indeed, many of the beauty industry’s mega companies are still operating a legacy model whereby a famous name is signed to be the face of a product line without much (or any) creative input.

But even when these companies take a more collaborative approach — as with Michelle Phan’s Em cosmetic line, produced by L’Oréal — they have to fight harder to be perceived as authentic. “Em cosmetics didn’t work for a lot of reasons, but one is that it was really seen as being a part of L’Oréal, and I think that lost credibility among consumers,” says Begley. Meanwhile, by keeping a low profile, and releasing products under their own distinct brand identities, private label companies like Seed and Hatch have figured out how to do big business without feeling inauthentic.

Importantly, they’ve also learned the art of listening to a new kind of hyper-engaged, hyper-informed consumer. “Ten, maybe 20 years ago brands could speak to large audiences with billboards and magazines and say, we are the best, and if you said it loud enough and long enough people will try the product,” says Sampson. “Now, it’s the consumer that says, no, I’ll tell you if you’re best. It used to be a linear pathway from brand to retailer to consumer. Now it’s turned into a triangle with the consumer in the middle. The power of the consumer is so loud that the minute you’re no longer true to what you say it hits like wildfire. If you say you’re building a brand with person X you better be building a brand with person X.”

“We’re not looking to hire faces or somebody just to represent,” adds Nelson. “We’re really looking to partner with people with a strong creative vision that want to bring that to life.” Otherwise, the products simply won’t pass the sniff test with beauty fanatics.

But how are these partnerships structured — and how well do influencers fare? That’s often where entities like Digital Brand Products, an offshoot of Digital Brand Architects, a digital talent management agency, are involved. “Usually we start with the influencer, they come to us and say ‘Hey, I have this beauty or apparel idea that I’m really passionate about creating and selling to my followers,’” says Daniel Landver, CEO of Digital Brand Products. “We take in what they’re saying and walk them through the process and the options — do we want a license deal, a partnership deal or do we want to go direct-to-consumer and not partner with a retailer.”

According to Hatch’s Sampson and Seed’s Nelson, both companies prefer partnership deals. “Each deal is structured differently based on what we’re trying to accomplish,” says Nelson. “We believe it’s important to go into everything with elements of partnerships. Those elements might vary, but generally we want our partners to enjoy the upside and have ownership.” Nelson, who declined to disclose specific numbers, says the company stays away from one-time payments and up-front fees as it feels “too transactional.” Instead, most of Seed’s partnerships involve some form of equity and profit sharing.

The power of the consumer is so loud that the minute you’re no longer true to what you say it hits like wildfire.

According to Sampson, Hatch expects their partners to make a genuine contribution to the team. “Ours is not a license agreement, it’s a partnership and we want to make sure these individuals have their stamp on it,” says Sampson. “The number one thing we look at when we partner with someone is, do they actually live up to what they say. We want to make sure they’ll want to be involved and give input and truly have a belief system.”

Of course licensing deals do come into play — and sometimes companies can take advantage of an influencer’s relative inexperience in business. “It’s just like anything else when you’re the new artist in town and your first record deal really sucks,” says Begley. “But then you make it big and you negotiate something better for your second record and you start making money. Once influencers can show the impact on business, they’re in the driver’s seat.”

“Deals don’t always work out well for the influencer, but I don’t know if I would say they are taken advantage of,” says Landver, who said that a license deal would have to be at least six figures or above for an established influencer to devote time and energy to it “Building a business is really hard and takes a lot of energy and a lot of times outsourced manufacturers are in it for a quick buck not building the brand.”

Landver, however, believes that an influencer’s clout can be leveraged for long-term success — which is why Digital Brand Products is in the process of closing a round of investment in order to incubate and build brands directly in-house. “Sometimes third-party manufacturers don’t execute at a level that’s strategic over a long period of time,” says Landver. “The old model is based on home-runs. We’re not looking at it that way. We’re looking at building a viable brand value over a longer period of time.”

Landver believes that the next big lifestyle brand—the next Tory Burch or Martha Stewart, say — will be founded by an influencer. Or several, actually. “As opposed to looking at one big hundred million-dollar brand, we’re looking at building many ten million dollar brands,” says Landver. “I say longtail five times a day. The future is going to be many more small brands focused on smaller segments.”

“What’s great about an incubator is you can create a scaleable model where you launch different brands with different belief systems within one portfolio,” adds Sampson. “If Hatch is an umbrella of a multitude of different brands then you can continue to stay interesting and relevant. That’s where incubators have a leg up because you can cater to different markets, and play in every segment and retail channel.” Indeed, when an influencer’s star begins to fade, incubators can easily pivot — and move onto the next.

The Secret Company Behind KKW Beauty and Kylie Cosmetics

If you’ve watched “Keeping Up With the Kardashians” (and who hasn’t?), you’ve likely witnessed sisters Kylie and Kim touching base with the larger teams behind their most-popular beauty brands, Kylie Cosmetics and KKW Beauty. Onscreen, of course, the meetings are cut short—quick snapshots and a few lines exchanged without much context given to flesh out the other players gracing the camera. Their product launches and pop-up openings come and go at warp speed—but what it takes to bring these ideas to life, and the people involved in doing so, goes unseen.

That’s exactly how Seed Beauty, the company behind both Kylie and Kim’s brands, wants it to be. Founded by siblings Laura and John Nelson in 2014, the beauty brand incubator is responsible for much of these brands’ success. Seed made its debut with Colourpop, an instantly buzzy cosmetics company whose success is founded on strategic influencer partnerships. One of the first brands to trumpet the liquid lipsticks that would become a Kylie Cosmetics staple, Colourpop has collaborated with beauty vloggers like Kathleen Lights and Jenn Im. It now has 5.9 million followers on Instagram, toppling the fanbases of onetime beauty juggernauts like Estee Lauder (2.6 million followers) and Revlon (1.6 million followers). Partnering with the Kardashian-Jenners took this model to the next level.

KKW Beauty

“At its heart, Seed Beauty is an entrepreneurial brand lab,” explains Jodi Katz, a beauty industry expert and the founder and creative director of Base Beauty Creative Agency. “Its whole reason for being is to not follow any industry rules.”

Seed’s sibling co-founders were inspired to launch the business after honing their craft while running Spatz Laboratories, the beauty industry supply company owned by their father. But they put a distinctly millennial spin on their father’s model: As the beauty bubble grew online, fueled by the rise of trend-driven YouTube and Instagram tutorials, the Nelsons saw an opportunity to manufacture products inspired by whatever was currently making waves on social media. Given that over 55 percent of people now say social media is the driving force behind their purchasing decisions, the timing was ripe.

The real key to Seed’s success—and the reason the Kardashians courted them—was speed. “There was an opportunity to bring the fast-fashion model to beauty,” says Laura Nelson, president and co-founder of Seed Beauty. While many brands now look to social media for product inspiration, Seed was doing so at a much quicker pace than the industry was used to, one better suited to a digitally native generation.

RELATED: Kylie Jenner and Travis Scott on That "Kardashian Curse" Plaguing the Family's Boyfriends

Kylie Cosmetics

Today, the company boasts that it can take a product from concept to creation in a mere five days—a speed at which other companies, like E.l.f. Beauty and Winky Lux, are now trying to recreate. Given that traditional beauty companies like Estee Lauder and L’Oreal often take up to two years to develop and launch new products, this timeline is a feat.

It helps that Seed has total control of its manufacturing process, working on everything from product development to marketing, all under one roof on a 200,000-square-foot campus in Oxnard, Calif. All of its six brands—alongside the aforementioned three, there are a few hush-hush brands in development—are also digital first, allowing each one to develop new products quickly and launch them immediately.

“This flexibility allows us to remain culturally relevant and at the forefront of new trends,” says Nelson.

Kylie Beauty

As does endless social listening, the lifeblood of Colourpop, Kylie Cosmetics, and KKW Beauty. Seed employees use various platforms to closely track whatever’s blowing up the beauty space online, whether it’s a type of concealer or a new smokey eye, and are constantly chatting with the brands’ consumers for constructive feedback.

“We use our social platforms and tools to ask consumers what they want [rather than] telling them,” explains Nelson, who notes that the most important qualities in a beauty brand today are “relatability, authenticity, originality, and quality.”

Calling the Kardashians relatable might be a stretch. How many of us are flying on private jets and cavorting around Fashion Week, not to mention married to Kanye West? But their appeal, and the intimate relationship their fans feel they share with the Calabasas family, can’t be denied. Products from Kylie Cosmetics and KKW Beauty routinely sell out, and tens of thousands of people line up for their pop-up shops, requiring ample security to keep the makeup-crazed crowds at peace. Many of their products—from Kim’s contour kits to Kylie’s lip kits—are often re-sold on sites like eBay for hundreds of dollars.

RELATED: Rosie Huntington-Whiteley’s Very Specific Intermittent Fasting Protocol

KKW Beauty

It’s no surprise, then, that Forbes just announced that Jenner is on track to become the youngest-ever “self-made” billionaires, reporting that she’s built an $800 million fortune off her makeup empire in just three years.

Nelson, for her part, refused to speak about either of the celebrity brands specifically, only noting that Seed’s relationships were never intentionally confidential. Quiet might be the better descriptor.

Still, the Kardashian-Jenner women are said to be fairly hands on in the process, driving initial product vision from the get-go and checking in with the product development teams once to twice a week to make any necessary tweaks.

Nelson hasn’t always been so close-lipped, telling Shopify last year that it was Jenner who first approached her about starting a brand in 2014.

RELATED: I Tried Everything to Quit Biting My Nails—Here’s What Finally Worked

Laura Nelson

“Kylie came about it from the same way that I've learned that she comes about many other things, which is to find the most direct path. That's one of the reasons that we work very well together,” Nelson said at the time. “Our capabilities in the business matched with her vision and reach—that's the magic that has allowed Kylie Cosmetics to have scaled the way it has been able to scale in just 12 months.”

Seed’s role in the launch of KKW Beauty last year has remained even quieter, which many of Nelson’s industry peers say is simply smart business—an attempt to keep the “secret sauce” inherent to both companies success, well, secret. Seed Beauty’s website provides little information, and it has no social media presence, which might seem ironic for a company trumpeting digital-first.

“It doesn’t surprise me that Seed’s founders are keeping a low profile. They understand the power of a brand to connect with the hopes, dreams, and fantasies of a consumer, and they know that they are not the brand,” says Katz. “Think of the swirl of excitement around a Kardashian product launch—[you] wouldn’t want Seed’s own amplification to get in the way of that incredibly voluptuous energy on social.”

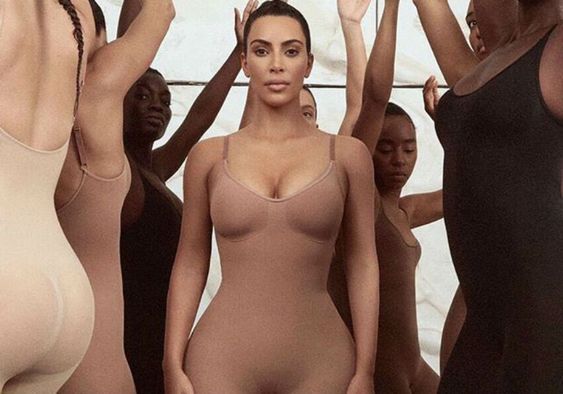

KKW was tired of cutting and sewing her shapewear—so she decided to create her own.

Kim Kardashian West attends the amfAR New York Gala 2019 at Cipriani Wall Street on February 6, 2019 in New York City

JARED SISKIN/AMFAR/CONTRIBUTOR/GETTY IMAGES

In true Kardashian fashion, Kim Kardashian West's much-anticipated shapewear brand, SKIMS, dominated the news cycle months before its launch date.

After a controversial name change and a buzzy social media campaign (featuring both everyday women and the Kardashian/Jenner sisters), KKW's line of curve-friendly, shape-enhancing undergarments is ~officially~ available to purchase today at skims.com.

Following a decade-long quest for shapewear that comfortably slimmed and smoothed her own silhouette, Kardashian West developed an innovative strategy for creating undergarments to fit a wide range of body types and needs. (Related: These Celebs Are Totally Obsessed with Spanx Workout Clothes)

"My approach to creating SKIMS was solution-focused," Kardashian West tells Shape. "I rely on solution-wear to accentuate and enhance my body and often I found myself cutting and sewing existing shapewear to work specifically for each look that I was going for. I knew I wasn't alone in looking for the perfect shapewear and turned my passion into something real that would work for every body type.

Among these problem-solving pieces, the Solution Short (Buy It, $42, skims.com) is Kardashian West's personal favorite: a one-legged boy short perfect for high slits and red-carpet moments.